Archive

Obama Apologizes for Insurance Cancellations Due to Obamacare [Video]

President Obama apologizes to the country after many Americans have lost their health care plans because of Obamacare.

For more videos from CNN, click here.

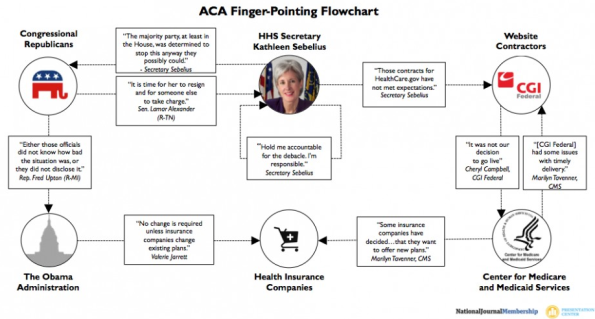

The Obamacare Finger-Pointing Flowchart

The rollout of Obamacare has been nothing short of a disaster. Here is a flowchart from the National Journal that helps explain some of the finger-pointing going on.

Hat Tip: Floating Path

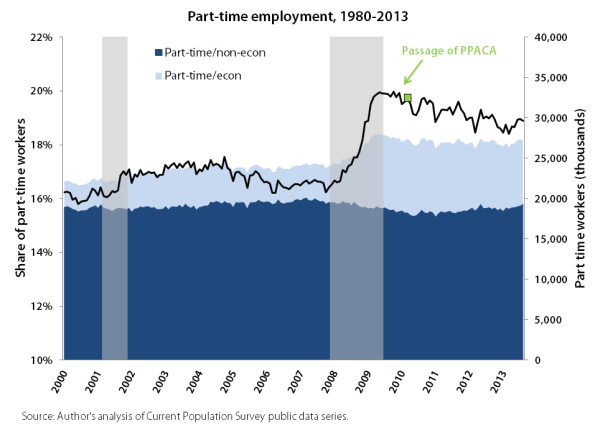

Any Correlation Between Obamacare and Increase in Part-Time Employment?

It is no secret that the merits of Obamacare are a hotly debated topic and often leads to partisan discussions. One particular criticism of President Obama’s most significant legislative achievement to date is that it is causing an increase in part-time employment.

Barry Ritholtz from The Big Picture has a different take. According to Mr. Ritholtz, the assertion that Obamacare caused an increase in part-time employment is a “classic bit of misdirection — an assumption built into a question.” Reflecting on the chart provided below (via Economic Policy Institute), he observes:

As you can see in the black line below, the number of part time workers spiked because of the Great Recession. It peaked and began to slowly reverse before the ACA was even passed. No, there does not appear to be an increase caused by Obamacare.

Source: Did Obamacare Cause an Increase in Part-Time Employment (The Big Picture)

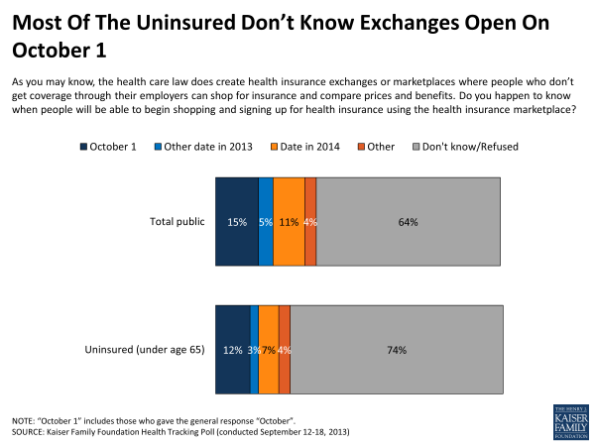

Most Uninsured Americans Don’t Know Exchanges Open On October 1, 2013

The Affordable Care Act, better known as “Obamacare,” is supposed to provide more opportunities for the uninsured to get affordable health care insurance. However, according to a recent Kaiser Family Foundation poll, it appears that nearly three-quarters of the uninsured are unaware of the fact that health care exchanges will open up on October 1st.

So this is evidence that Obamacare is a law destined to fail then, right? Well, one can view the above-referenced poll in at least two ways. Sarah Kliff from the Wonkblog explains:

There are two ways to think about these poll numbers. One is that they’re a disaster: The White House has had more than three years now to talk about the Affordable Care Act, hype its benefits and get the word out about a sweeping new legislative accomplishment. If people are this uninformed right now, how are they ever going to hit projections of 7 million people enrolling in the first year?

That’s the pessimistic take. But there’s also a more optimistic case I hear when I talk to people running these marketplaces — who, it’s fair to say, have a vested stake in staying optimistic about these things. They contend that knowing that the exchanges launch on Oct. 1 is essentially meaningless for the people they’re trying to reach. Those people could sign up on Oct. 1 or Dec. 1 and still access exactly same benefits under the health-care law, since coverage purchased on the marketplaces doesn’t start until January.

Bottom line: It’s way too early to tell whether Obamacare will be a success. That said, the White House has done a terrible job at explaining the basics of the law to the general public.

Source: Three-quarters of the uninsured don’t know when Obamacare starts (Wonkblog)

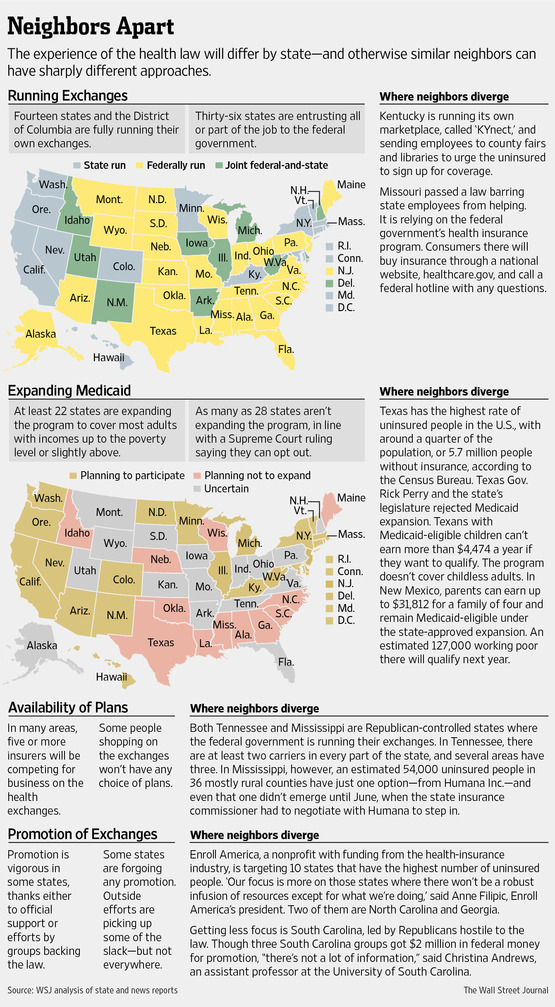

Health-Law Implementation to Vary by State

Many of the main provisions of Obamacare are set to kick in on October 1st. Be that is it may, the experience of the federal health care law will differ by state as some states are running their own health insurance exchanges, while others are letting the federal government handle that task. The Wall Street Journal provides this great graphic which highlights some of the notable divergences between states.

Source: WSJ

House GOP Votes to Defund Obamacare

This past Friday, the Republican-led House passed a short-term government spending plan that would eliminate all funding for Obamacare. Unsurprisingly, the GOP plan was approved in an almost strictly party line vote.

So what’s next? The measure will now go to the Democratic-led Senate, which is certain to reject the provision that defunds President Obama’s signature legislative achievement of his first term.

Here are more details from CNN:

In legislative jargon, the House passed a continuing resolution that would keep the government funded for the first 11 weeks of the fiscal year that begins October 1. Without some kind of spending measure by then, parts of the government would have to curtail services or shut down.

The controversy involves the provision demanded by the GOP’s conservative wing and agreed to by Boehner that eliminates all funding for the 2010 health care reforms popularly known as Obamacare.

Approval by the House set in motion a Capitol Hill showdown that will continue through October, when the nation’s debt ceiling must be increased so the government can pay all its bills.

The two-stage process includes the possible government shutdown at the end of the current fiscal year on September 30 if there is no compromise on a spending resolution, followed by a potentially even more rancorous debate over raising the debt ceiling.

See also: House passes GOP spending plan that defunds Obamacare (Washington Post)

Obamacare’s Metallic Health Insurance Levels [Infographic]

Seven Things You Need To Know About Obamacare’s Final Regulations

Last week, the Obama administration released the final regulations for Obamacare’s individual mandate. In particular, the individual mandate provision essentially requires most Americans to purchase health insurance or pay a fine.

Here are seven things you need to know about the mandate via Forbes:

1. You pay a fine if your spouse and kids are uninsured.

2. Pretty much any employer-sponsored plan meets the mandate’s requirements.

3. The mandate fine is small, and will have even less impact over time.

4. The IRS can’t criminally prosecute you if you don’t pay the fine.

5. Many older individuals will be exempt from the mandate.

6. If you don’t file a tax return, you’re exempt.

7. ‘Members of recognized religious sects’ and American Indians are also exempt.

To read more about the key takeaways listed above, click here.

Controversial Ballot Measure Results: Election 2012

Here is a great infographic from the Pew Center on the States regarding 2012 controversial ballot measures that were voted on across the country:

Source: Pew Center on the States

Breaking Down the Obamacare Penalty Tax

So will all Americans be forced to purchase health insurance following the Supreme Court’s recent ruling on Obamacare? Here are some key points, from FactCheck.org (via Business Insider), about the penalty tax:

- The penalty/tax will be phased in from 2014 to 2016.

- The minimum penalty/tax in 2016 will be $695 per person and up to 3-times that per family. After 2016, these amounts will increase at the rate of inflation.

- The minimum penalty/tax per person will start at $95 in 2014 (and then increase through 2016)

- No family will ever pay more than 3X the per-person penalty, regardless of how many people are in the family.

- The $695 per-person penalty is only for those who make between $9,500 and ~$37,000 per year. If you make less than ~$9.500, you’re exempt. If you make more than ~$37,000, your penalty is calculated by the following formula…

- The penalty is 2.5% of any household income above the level at which you are required to file a tax return. That level is currently $9,500 per person and $19,000 per couple. The penalty on any income above that is 2.5%. So the penalty can get expensive quickly if you make a lot of money.

- However, the penalty can never be more than the cost of a “Bronze” heath insurance plan purchased through one of the state “exchanges” that will be created as part of Obamacare. The CBO estimates that these policies will cost $4,500-$5,000 per person and $12,000-$12,500 per family in 2016, with the costs rising thereafter.

- Those who make less than $9,500.

- Employees whose employers only offer plans that cost more than 8% of the employee’s income.

- Those with “hardships.”

- Members of Indian tribes.

- Members of certain religions that don’t pay Social Security tax, such as Amish, Hutterites, or Mennonites.